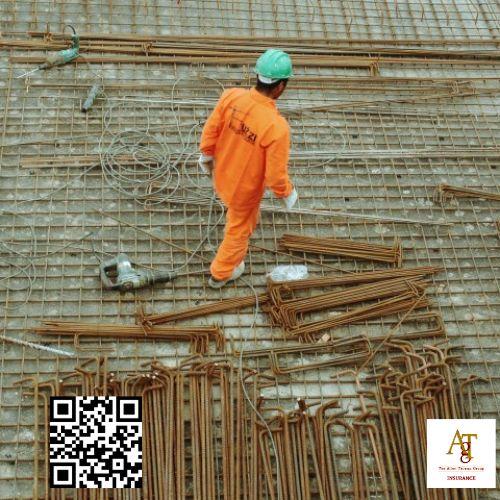

Construction Business Insurance

Commercial property insurance

Being accused of negligence by an injured worker can also quickly generate a draining lawsuit. Insurance doesn't have to be complicated!

In most cases, independent and self-employed contractors aren’t required to carry workers’ compensation insurance.

Construction claims are complex and potentially volatile.

When you insure your business with The Allen Thomas Group, you get loss control tools and a team who can review your operations, procedures and programs.

Construction Business Insurance - Bodily injury

- Rental property insurance

- Liquor liability

- Named perils

- Professional indemnity

The Allen Thomas Group Contractor Insurance .